In doing so, businesses of all sizes and ages can make strategic plans and develop realistic objectives. Accounting software eliminates a good deal of manual data entry, making it entirely possible to do your own bookkeeping. However, it can be difficult to catch up if you fall behind where petty cash appears in the balance sheet on reconciling transactions or tracking unpaid invoices. Cash basis accounting records transactions when money changes hands. This method doesn’t record invoices or your company’s outstanding bills until they’ve been paid.

Petty cash bookkeeping is a single-entry system that simply records the total amount of money you have in your petty cash drawer. If you’re using an actual cash box for this, it’s best to keep track of each entry. This way, you can determine how much change remains at the end of the day.

Simply put, business entities rely on accurate and reliable bookkeeping for both internal and external users. Bookkeepers are individuals who manage all financial data for companies. Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company. Ask for testimonials from people who have utilized your services in the past and spread the word about your offerings through a website or social media. Your general ledger should be up to date, so your bookkeeping software must provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers.

- It’s true—accounting may be the least fun part of running a small business.

- As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive.

- In some cases, this information is needed only at the end of the year for tax preparation.

- Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently.

- The skills needed to become a successful bookkeeper are often acquired through working in a career in the finance industry or even by balancing your personal budgets.

What Is Financial Bookkeeping?

Without this information, it is impossible to know how well (or not so well) you’re doing. As stated previously, the product of bookkeeping is financial statements. Bookkeeping allows investors to have up-to-date and accessible information.

Bookkeeping vs. accounting

At KPI, we offer a modular system that serves all your accounting needs. Government regulations often require businesses to maintain financial records. Regular bookkeeping ensures that businesses stay compliant and avoid any penalties or legal issues. The backbone of a successful business lies in its financial management, and bookkeeping plays an indispensable role in this regard. This article will delve into the importance of bookkeeping, including the significance of double-entry bookkeeping and how it can benefit your business. We’ll also cover how to get started with bookkeeping for a sound financial footing.

Reasons Why Bookkeeping is Important for Businesses

The purpose of accounting is to maintain financial records that pertain to your business while tracking business performance. If you’re like most modern business owners, the odds are that you didn’t become one so that you could practice professional-grade bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and quickbooks set up new company growth. The balance sheet, income statement, and cash flow statement all present the value of your business, which allows investors to have up-to-date and accessible information. Some accounting software products automate bookkeeping tasks, like transaction categorization, but it’s still important to understand what’s happening behind the scenes.

Wave provides a cloud-based solution for businesses looking to do their bookkeeping themselves. It’s a great choice if you’d like to manage your finances from anywhere and won’t require additional assistance. A financial advisor or accountant can provide you with some guidance on the best type of bookkeeping software for your business.

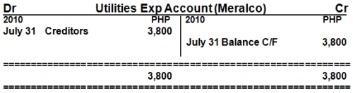

With accounting software, you can keep track of your business performance with just a few clicks. Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business. It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. A double-entry bookkeeping system has two columns, and each transaction is located in two accounts. You enter a debit in one account and a invoice number credit in another for each transaction.

Business

Both reports should be easy to comprehend so that all readers can grasp how well the business is doing. To get started with bookkeeping for your business, first, choose a bookkeeping method (single-entry or double-entry). Next, select accounting software to simplify the bookkeeping process. Organize and categorize transactions, and establish a routine for recording and reviewing them. If needed, seek professional help from an accountant or bookkeeper. Bookkeeping is an essential aspect of running a successful business.

For example, let’s say that your business is losing money each month or that your overhead costs are too high. You can make changes by improving processes or evaluating purchases. However, you also need the right type of bookkeeping software to evaluate this information correctly.